Who is concerned

- CEOs seeking to manage around the current economic turbulence

- Executives in the construction sector, real-estate sector or a heavy industry sector

- Real-estate investors

- Investors in tier 2 and lower cities

- Commodities investors

- Investors in green industries

In a nutshell

Certain sectors of China’s economy are experiencing massive capacity gluts. Yet in order to stimulate the economy, the government still seeks to encourage capacity. The economic impact is expected to be consumption crises in certain provinces, alleviated by government aid packages.

More Information

Capacity excess started as a result of the stimulus program which followed the 2007 economic crisis. By 2012, it had become sizable.

China Industrial Average Capacity Utilization

(as % of full capacity, 1998 – 2011)

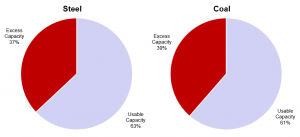

Since then, it has continued to increase. The steel and coal sectors in particular are strongly impacted:

Excess Capacity in the Steel and Coal Sectors

(in % of quantity, 2015)

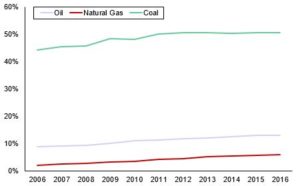

This has been one of the factors behind the crashing prices of global commodities. These crashes are caused in part by the glut in petroleum production, in part by the softening demand – and particularly Chinese demand – for petroleum and commodities in a weak world economy, and in part by oversupply and idle capacity in China.

China petroleum, Coal and Natural Gas Consumption As Percentage of World

(% of total world consumption, 2006 – 2016)

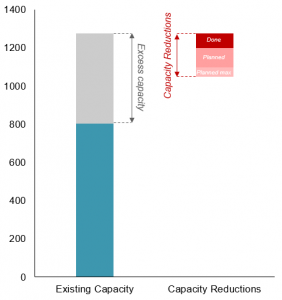

The government has demonstrated its intention to address the over-capacity issue:

Capacity Reductions in the Steel Sector – Actual and Planned

(in Million Tons, 2015)

China’s overcapacity issue is a sensitive one for Western countries, given the consequences of the Chinese glut – particularly on jobs in heavy industries of other countries. Mr. Lou Jiwei, China’s finance minister, provides an interesting glimpse into the behind-the-scenes discussions that surround this issue: “At the time [of the 2007 crisis], the whole world was grateful that China had boosted world growth [by building up capacity]. Now the world is pointing its finger at China’s overcapacity problem, saying it’s dragging down the whole world. What about what the world was saying before?”

What to do about it

- CEOs seeking to manage around the current economic turbulence: if you are not in one of the sectors with over-capacity, plan around a reduction of consumption in areas that are heavily industrialized. Also expect that banks will be unpredictable in their willingness to extend credit. They are subject to competing influences, namely: government stimulus on the one hand, and government pressure to reduce non-performing loans on the other.

- Executives in the construction sector, real-estate sector or a heavy industry sector: given over-capacity in these sectors, plan for consolidation and survival of the fittest. However, note that much municipal debt is tied to these sectors, particularly real-estate. (Real-estate is a major source of municipal revenue, and also a major component in many municipal financing schemes.) The central government is currently seeking to resolve the municipal debt issue, and will not want to rock the boat in the short term.

- Real-estate investors: much municipal debt is tied to real-estate. The central government is currently seeking to resolve the municipal debt issue, and will not want to rock the boat in the short term. Furthermore, extra demand from the government urbanization drive can absorb excess capacity in the medium term.

This assumes that excess supply does not further increase: much of new demand from urbanization tends to be mismatched with current excess supply. Only a small percentage of this new demand will go towards absorbing excess supply. - Investors in tier 2 and lower cities: in areas that have sizable excess industrial capacity, expect reduction in consumption, but also further government stimulus

- Commodities investors: as heavy industry and construction sectors weaken in China, expect worldwide downward pressure on the commodities that feed into these sectors

- Investors in green industries: the government’s determination to close coal capacity provides an opportunity for it to shift to less polluting sources of energy. Watch closely whether it chooses do do this. Move slowly, bearing in mind that the government will likely move slowly.

Jarvis Kudley

MN