Who is concerned

- Entrepreneurs

- Real-estate investors

- Companies newly opening a branch in China

- Tourism note: while in the area, you might want to visit the aircraft carrier (3.5 stars on TripAdvisor.)

In a nutshell

We have all heard about China’s ghost towns: massive real-estate developments that remain empty, funded by over-eager municipalities. A classic case of wasted resources.

Binhai New Area CBD is one of them. But something strange is happening there: recently, after having gone down for a while, real-estate prices have been booming (104% annualized growth rate), much more than those in more desirable areas (e.g. 13% for Beijing during the same period). We need to reconsider whether *all* such developments truly are cases of waste. In Binhai New Area CBD, the markets do not consider the area a waste.

In depth:

The most frequently cited ghost town in China is usually described as “an imitation of Manhattan, but completely empty.” This is supposed to be a description of Binhai New Area.

Binhai has been positioning itself as an attractive location for business registration.

GDP Growth Rate and Number of New Registered Companies (2015)

In 2016, Binhai announced a number of incentives to attract start-ups and develop a cluster:

- Subsidized office rent will be provided

- An investment guidance fund will be set up

- Preferential household registration policies will be made available in order to attract “innovative and entrepreneurial talent”

- For both domestic and foreign research institutions which purchase more than 20 million RMB of research equipment, a one-time grant of 3 million to 5 million RMB subsidy will be given by the government

- In order to develop the public areas, 1 to 5 million RMB of operating subsidies will be given each year to all kinds of publicly accessible space, with the maximum subsidy period being three years.

- Free services such as company registration, qualification application, patent application, etc. will be provided

This has resulted in a quick and steep rise in prices:

Average Selling Price of Real Estate in Tianjin Binhai New Area1 (RMB/㎡, 07/2015 – 07/2016)

Does this mean that commentators were wrong about Binhai CBD? Not necessarily, we need to dig deeper. Occupancy rates remain abysmal:

- 63 buildings in total are expected be ready to use in the year 2020.

- 22 buildings have been put into use so far

- Only half of them are occupied according to government reports

This indicates that demand is coming from real-estate developers, not from real users.

So whether Binhai’s extra real-estate is useful or wasteful depends on whether the real-estate speculation in Binhai forms a bubble.

The best way to identify a bubble is to check whether there is a belief that prices cannot go down. This belief is very present in Chinese real-estate.

What is happening in Binhai does appear to be a bubble; however before concluding, we should take a look at what happens to real-estate bubbles after the bubble pops.

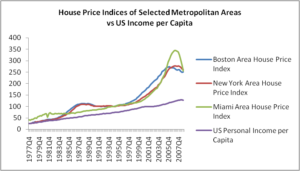

Evolution of house prices before and during a real-estate bust – three key real-estate markets in the US.2

General price levels (as opposed to those of the most sensitive properties) do not erase the gains that they made during the preceding years. In fact, for many areas, such as Boston and New York in the above graph, prices do not so much collapse as decrease, leveling out for a while.

We expect that a use will be found for the Binhai extra real-estate capacity, especially given the rapid and on-going urbanization of China. We also expect that prices will not collapse so much as perhaps level off.

What to do about it

- Entrepreneurs: for the time being, the benefits promised to start-ups are outweighed by the extra cost: longer transits, higher rent, distance from Tianjin and Beijing city centers.

-

B2B companies: due to the high costs, the sort of SMEs opening in Binhai tend to be more mature, larger, and with more experienced management when compared to the typical start-up. These are better prospects for B2B, and particularly business service providers.

-

Real-estate investors: avoid investing in this area, unless you:

– Have the patience to invest for the very long-term

– Are willing to accept the risk of expropriation which such a long horizon entails

– Have taken into account that in China land is not sold, but rented, typically for 70 years. So your investment must be recovered within that period

- Companies newly opening a branch in China: Binhai and its likes present several advantages for you: government incentives, a more mature/professional than average Bureau of Industry and Commerce (which as of writing is still motivated to attract business), and probably, with time, proximity to B2B providers and synergies with other corporate head offices